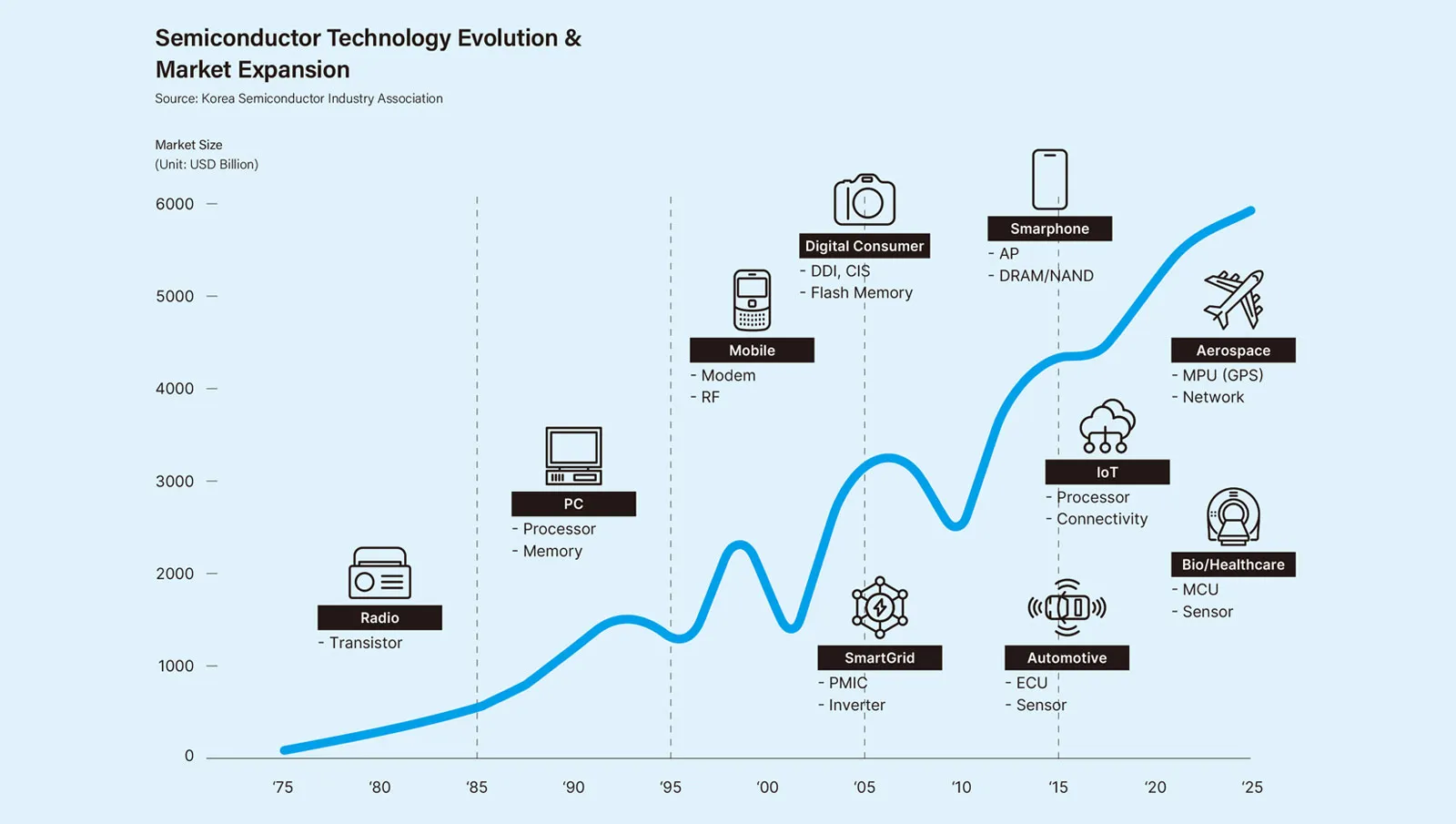

Korea’s semiconductor industry did not start with cutting-edge design and manufacturing. In the 1960s, the focus was on simple tasks like assembling and packaging chips brought in from overseas. But from the mid-1970s, Korea began producing integrated circuits (ICs) directly, and in the 1980s it jumped into DRAM development in earnest. In the 1990s, Korea enlarged wafers (the round disks on which ICs are printed), automated production processes, and made massive facility investments, catching up to Japan and the United States in the memory sector and securing world-class competitiveness.

The strength of Korea’s memory industry comes from its ability to implement fine processes quickly and accurately, minimize defective products, and carry out mass production efficiently. By precisely controlling the conditions of each individual process and simultaneously developing equipment and materials with partner companies, Korea has built unmatched manufacturing capabilities in high-value-added DRAM, NAND flash and High-Bandwidth Memory (HBM). In simple terms, Korea developed the ability to produce finer, denser circuits in greater quantities, more cheaply, and more reliably.

Government policy was also a key pillar of growth. Starting in the 1980s, semiconductors were designated a national strategic industry, with steady promotion of large-scale R&D funding, low-interest financing policy, tax benefits and workforce training programs. In particular, the government strengthened industry-academia-research cooperation systems so that universities, research institutes, and companies could jointly develop technology and cultivate talent, sharing at the national level the high-cost, high-risk structure that companies would struggle to bear alone.

In terms of human resources, Korea experienced a “brain gain” after outstanding talent who studied in the U.S. in the 1970s returned en masse in the 1980s to lead core technology development at Samsung Electronics, Hyundai Electronics, LG Semiconductor and other companies. The Seoul National University Semiconductor Research Center, established in 1988, played a hub role in systematically training domestic semiconductor specialists and broadened the foundation for industrial growth.

The contribution of research institutions cannot be overlooked either. The Korea Institute of Electronics Technology (the predecessor of Electronics and Telecommunications Research Institute) developed 32K read-only memory (ROM) in 1982, then successfully developed 4M DRAM together with the three semiconductor companies starting in 1986, marking the starting point of the “Korean semiconductor miracle.” This joint development experience instilled confidence that research institutes and companies could work closely together to create world-class products.

The industrial ecosystem also solidified gradually. In 1988, Korean equipment companies and sales agencies formed the Korea Semiconductor Equipment Association (predecessor of the current Korea Semiconductor Industry Association), which marked the beginning of ecosystem expansion from a memory manufacturer-centered structure to include materials, parts and equipment companies. Today, not only materials-parts-equipment firms but also foundries (contract manufacturing), fabless companies (design specialists) and back-end process firms (packaging and testing) have emerged in various fields, establishing a vertically and horizontally connected industrial structure. In particular, among mid-sized and small companies handling specialized equipment or test solutions, there is a steady increase in those possessing world-class technological capabilities.

From Assembly Lines to

Global Dominance

Semiconductor Industry

Head of Next-generation Intelligence Semiconductor Foundation

Semiconductors represent the first high-tech product in which Korea reached the global pinnacle, and they are a signature success story of how Korea’s economy was driven forward in a short period of time. With competitiveness centered on Dynamic Random Access Memory (DRAM) and NOT AND (NAND) flash memory, strategic government support, bold private-sector investment, and accumulated expertise from talented individuals and research institutions, Korea now stands at a turning point, as it leaps toward becoming a “comprehensive semiconductor powerhouse.”

Korean Semiconductor Industry’s Growth Trajectory

Korea’s Current Status in Semiconductors

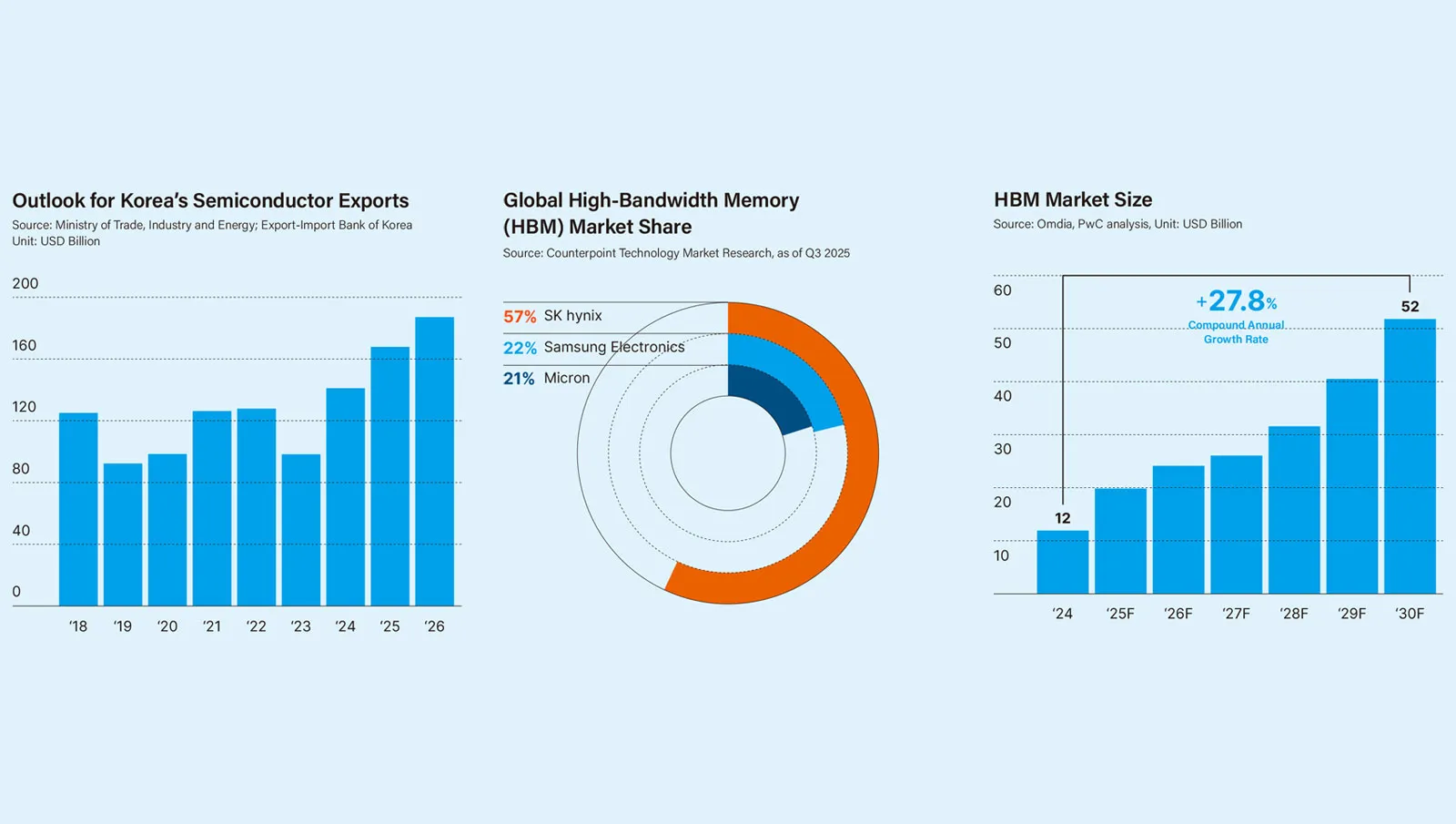

In the global supply chain, Korea’s semiconductors stand out above all in the memory sector. In DRAM and NAND flash, Samsung Electronics and SK hynix maintain first and second place in global market share, solidifying their leading position in technology, production and quality. Recently, as demand for high-performance AI accelerators has surged, Korean companies have established themselves as essential partners for global big tech in the HBM sector, where memory sits beside AI chips to exchange data at ultra-high speeds.

However, Korea’s position in the system ICs—a market estimated to be about three times larger than memory—is not yet substantial. In various system semiconductors such as central processing units (CPUs), communication chips, sensors and automotive semiconductors, Korea’s market share remains limited. But recently, in specific areas like AI accelerators and power ICs, there is a growing trend of mid-sized and small companies gaining recognition for their technological capabilities, so the possibility of expanding market share going forward is increasing.

In exports, semiconductors are already the number one contributor to Korea’s economy. For several years running, they have consistently accounted for approximately 15-20% of Korea’s total exports, and while they experience fluctuations with economic cycles, they maintain their position as a strategic product. In 2025, with memory price recovery and increased AI server demand, semiconductor exports hit all-time highs, and growth is expected to continue into 2026.

Going forward, semiconductors will no longer remain just one industry but will function as a common foundation for nearly all future industries. From electric vehicles and autonomous driving to biohealth, robotics, quantum computing, artificial intelligence and the space industry, the success or failure of cutting-edge industries will largely depend on semiconductor performance and supply stability. Amid these changes, Korea’s semiconductor industry is strengthening its competitiveness by expanding the scope of technology application into newly spotlighted areas like high-performance memory, AI semiconductors and automotive semiconductors.

Future Prospects and Challenges

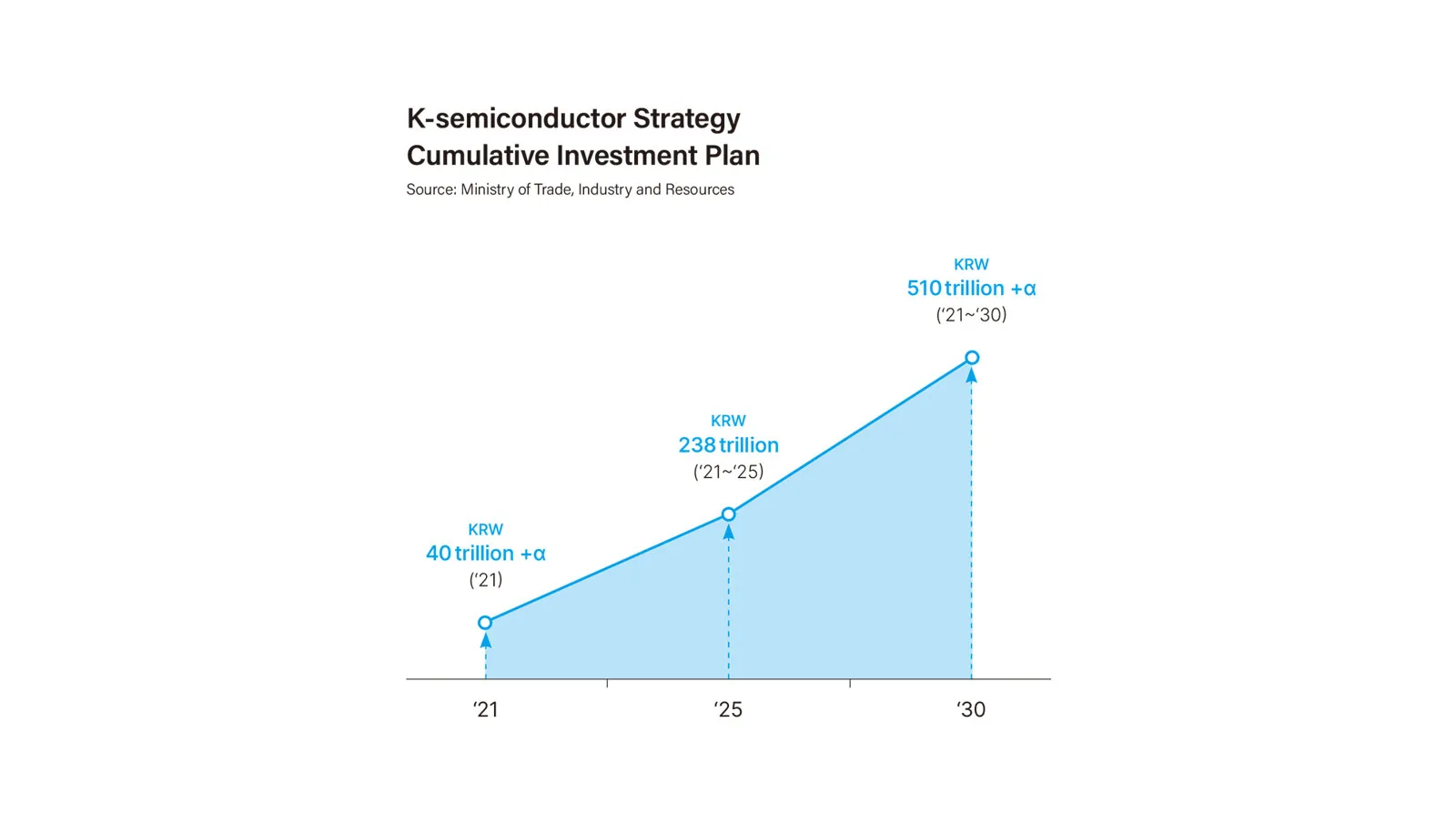

Through the “K-semiconductor Strategy,” the government has set goals to expand Korea’s global semiconductor market share to 30% by 2030 and to nurture power, automotive, and AI semiconductors as next-generation growth pillars. To this end, it is pursuing various policies including inducing large-scale private and public investment, easing location and environmental regulations, training specialized personnel, and expanding AI high-performance computing infrastructure.

However, the challenges ahead are significant. Global economic downturns, competition from rival countries, shortages of skilled workers and electric power, and strengthening environmental regulations are all factors increasing industry uncertainty. To achieve sustained growth, Korea must ease its memory-heavy focus, increase its market presence in the system ICs and foundries, and simultaneously raise the competitiveness of small and mid-sized companies along with materials-parts-equipment firms. In summary, the path forward requires transforming Korea’s memory excellence into comprehensive capabilities spanning the entire semiconductor sectors.